Trying to find the right way to handle your student debt sometimes feels like trying to avoid talking about the presidential election. Everyone seems to have Dracula XXX Porn Movie (1994)an opinion, so it’s easier to tune out and pretend it doesn’t exist. But your loans, like the election, won’t go away just because you want them to. So it’s important to know the details of your student debt.

We’ll help you get started by shedding light on four common student loan myths you might believe:

Public Service Loan Forgiveness isn’t the only way to get your federal loan debt wiped out. You can also get forgiveness if you sign up for one of the income-driven repayment plans, like Revised Pay As You Earn, which is available to all federal loan borrowers. For those plans, your monthly payment amount is tied to your income, and forgiveness applies to any debt you have left over at the end of your loan term. That’ll take 20 to 25 years, depending on which plan you sign up for.

If you qualify for both Public Service Loan Forgiveness, which forgives your debt after 10 years, and an income-driven repayment plan, you’ll save the most by opting for both. That’s because the income-driven plan will lower your monthly payment amount, so more debt can be forgiven after 10 years.

SEE ALSO: Why you shouldn't be spooked by student loansUse the Department of Education’s repayment estimator to see which income-driven plans you qualify for. You’ll have to reapply each year and, unless you go through the Public Service Loan Forgiveness program, you’ll have to pay income tax on any amount that’s forgiven.

Not necessarily. Debt that carries a higher interest rate than your student loans, like credit card debt or a personal loan, will leech money from your bank account faster than your student loans will. It’s best to tackle that debt first. But getting out of debt is just one part of financial security. You’ll also need to save for long- and short-term goals.

“An emergency fund and taking advantage of employer [retirement] matching contributions should almost always take precedence over paying off student loans,” says David Metzger, a certified financial planner at Onyx Wealth Management.

SEE ALSO: How a microloan helped my business growFigure out what you owe and what your interest rates are by logging into your various financial accounts. Then take a look at your monthly income and examine your spending habits from the past month. That way you’ll know which debts to pay off first, and you’ll be able to make room in your budget for both rent and retirement savings.

The truth is, it depends on when you took out your loans. Consolidation used to be a way to simplify your monthly payments, but recent grads usually have all of their federal loans with the same servicer, so it’s often no longer necessary.

Today, federal student loan consolidation is most useful in qualifying for Public Service Loan Forgiveness or income-driven repayment plans. That’s because Federal Family Education Loans, Stafford loans and PLUS loans need to be consolidated into a federal direct loan to qualify for those programs.

SEE ALSO: A 3-step plan for new grads with student debtBut if you have a Perkins loan and qualify for forgiveness, including it in consolidation would mean giving up forgiveness benefits for that loan. And if you have several different types of federal loans, it’s cheaper to exclude direct loans, since your new loan’s interest rate would be the average rate rounded up to the nearest 0.8%. Plus, your loan term will be extended if you owe more than $7,500, so you’ll end up paying even more over the life of your loan.

“If you are going to pursue an aggressive repayment of student loans, it would save you both time and money to repay the loans with the larger interest rates first, an option lost once you consolidate,” says Danna Jacobs, a certified financial planner at Legacy Care Wealth.

If you have student loans with interest rates over 6%, student loan refinancing could lower your interest rates and rein in long-term costs. It’s usually not a good idea to refinance federal loans through a private lender, though, since you’d have to give up federal borrower protections like income-driven repayment and forgiveness. To qualify for refinancing, you’ll need a steady source of income and a good credit score, typically 690 or higher.

Use NerdWallet’s student loan refinance calculator to see if it’s right for you.

Astronomers saw one galaxy impale another. The damage was an eye

Astronomers saw one galaxy impale another. The damage was an eye

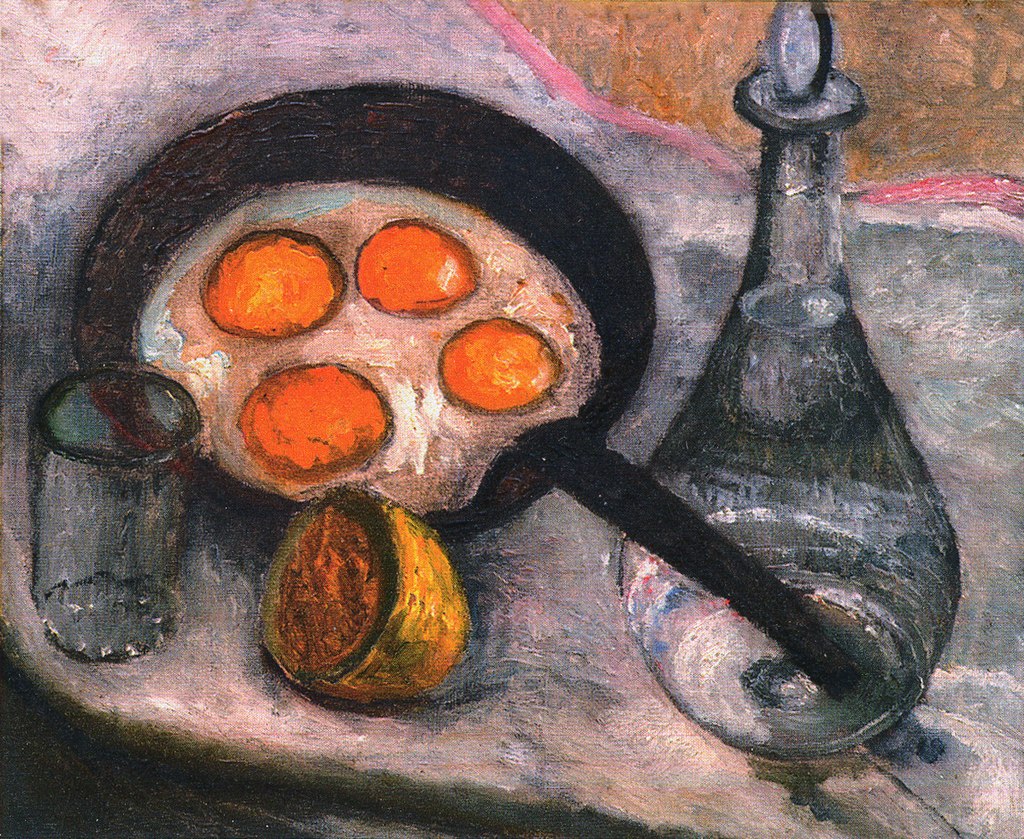

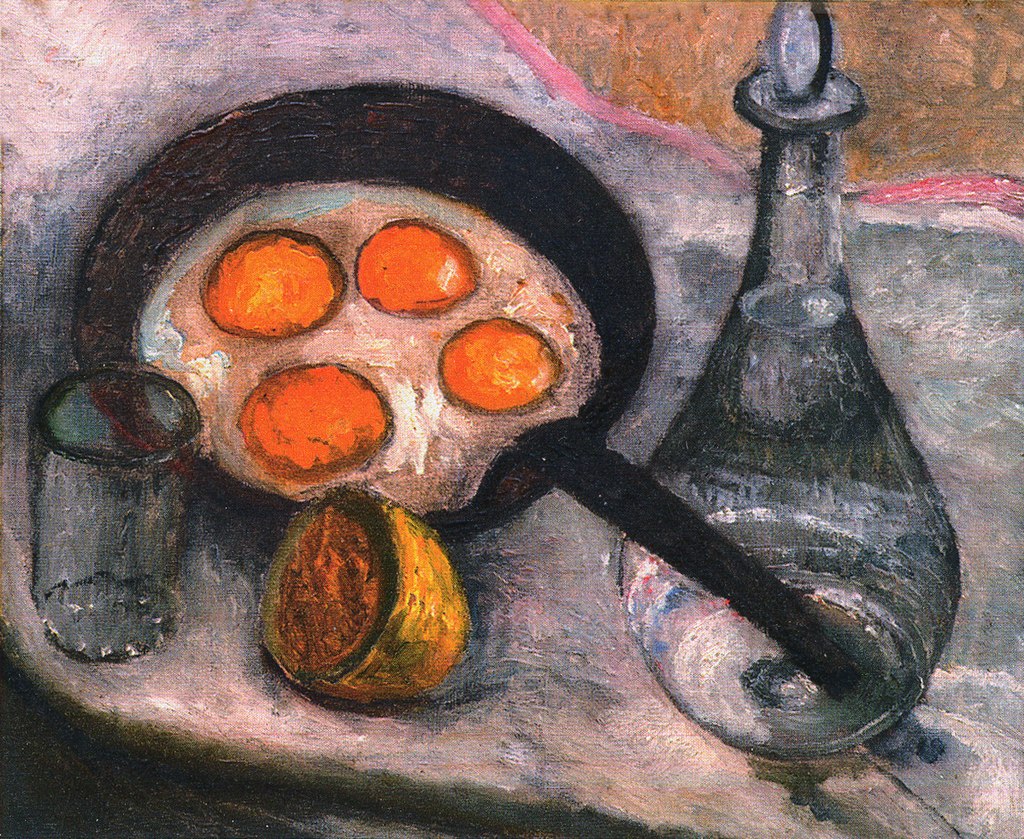

Cooking Peppermint Chiffon Pie with Flannery O’Connor by Valerie Stivers

Cooking Peppermint Chiffon Pie with Flannery O’Connor by Valerie Stivers

Five Letters from Seamus Heaney by Seamus Heaney

Five Letters from Seamus Heaney by Seamus Heaney

Is Craig Wright actually Bitcoin inventor Satoshi Nakamoto? This court is deciding.

Is Craig Wright actually Bitcoin inventor Satoshi Nakamoto? This court is deciding.

Your 'wrong person' texts may be linked to Myanmar warlord

Your 'wrong person' texts may be linked to Myanmar warlord

Apple Vision Pro: Watch these 3 Tesla drivers use it in the wild

Apple Vision Pro: Watch these 3 Tesla drivers use it in the wild

Galaxy S24 problems pile up: 4 issues plaguing Samsung's newest smartphone

Galaxy S24 problems pile up: 4 issues plaguing Samsung's newest smartphone

Making of a Poem: Patty Nash on “Metropolitan” by Patty Nash

Making of a Poem: Patty Nash on “Metropolitan” by Patty Nash

Skype is finally shutting down

Skype is finally shutting down

Apple Vision Pro launch day: My morning with Apple's true believers in NYC

Apple Vision Pro launch day: My morning with Apple's true believers in NYC

Put Me In, Coach!

Put Me In, Coach!

Three Letters from Rilke by Rainer Maria Rilke

Three Letters from Rilke by Rainer Maria Rilke

Costco in Cancún by Simon Wu

Costco in Cancún by Simon Wu

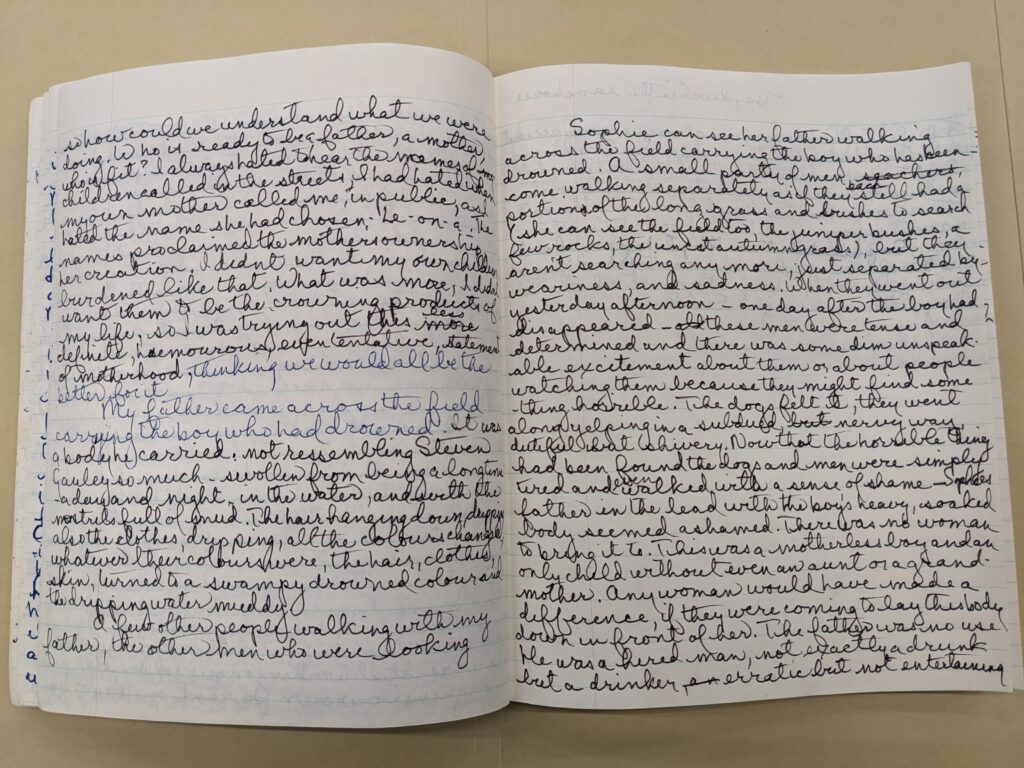

Inside Alice Munro’s Notebooks by Benjamin Hedin

Inside Alice Munro’s Notebooks by Benjamin Hedin

Against Fear

Against Fear

Costco in Cancún by Simon Wu

Costco in Cancún by Simon Wu

Three Letters from Rilke by Rainer Maria Rilke

Three Letters from Rilke by Rainer Maria Rilke

The ABCs of Gardening by Adrienne Raphel

The ABCs of Gardening by Adrienne Raphel

Against Fear

Against Fear

At the Webster Apartments: One of Manhattan's Last All

At the Webster Apartments: One of Manhattan's Last All

Kevin Killian’s Memoirs of SexedStaff Picks: Big Fish, Bombay, and Busted Pinkie Toes by The Paris ReviewLaurie Anderson on Ingrid SischyBisexuality and the anxiety of not feeling 'queer enough'Best Apple M2 Mac mini deal: Get the M2 Mac Mini for $100 offStaff Picks: Singing, Sequins, and Slaughterhouses by The Paris ReviewLaurie Anderson on Ingrid SischyThe Sight of Dawn by Nina MacLaughlinI successfully haggled with an AI garage sale by empowering itWordle today: The answer and hints for November 28Staff Picks: Whisky Priests, World’s End, and Brilliant Friends by The Paris ReviewA True Utopia: An Interview With N. K. Jemisin by Abigail BereolaBest bird feeder deal: Get the solarYan Lianke Illuminates Contemporary China by Carlos RojasRedux: The Old Juices Flowing by The Paris ReviewOnline misinformation runs rampant during coup attempt in RussiaToward a More Radical Selfie by India EnnengaCyber Week unlocked phone deals: Apple, Google, Samsung, moreThe Sound of Dawn by Nina MacLaughlinWhat's wrong with my houseplant? Here's how to figure it out. Simone Biles kindly shared her very own post Police arrest hackers behind explosive Fireball malware that infected 250 million computers Gamer accidentally sets herself on fire during livestream Stephen Colbert is producing an animated series about Trump and oh my god is this real life? Google will combine YouTube Red and Google Play Music into one service Live TV reporter acts perfectly calm as spider casually crawls all over her Katy Perry tapped to host MTV VMAs Tesla Model 3 delivery event will be livestreamed 'Game of Thrones' board game already funded over 200% on Kickstarter 'True Detective' Season 3 'will be a go' as soon as HBO nails down a director Waze on Android Auto finally makes real time alerts actually useful Amazon still doesn't profit from selling stuff 4 ways white parents can support black parents in times of injustice 'Big Little Lies' Season 2 is a possibility, says HBO 'Overwatch' League pros guaranteed at least $50,000 a year plus benefits Leaked image might show the iPhone 8's wireless charging setup Why is BuzzFeed selling a hot plate? Because it sucks to be a media company right now. Jeff Bezos is now the world's richest human Sean Spicer could very well appear on 'Dancing with the Stars' and these 5 other shows HTC's standalone Vive headset could save VR from AR's assault

2.5201s , 8223.6953125 kb

Copyright © 2025 Powered by 【Dracula XXX Porn Movie (1994)】,Openness Information Network